Vietnam Airlines is adding flights on domestic routes as restrictions ease.

Credit: Airbus

While a full recovery remains a distant prospect for the Asian airline industry, encouraging signs are emerging in some important domestic markets.

China has been an early leader in rebuilding domestic capacity, and more recently South Korea and Vietnam have begun to follow suit. However, the fact that domestic schedules are still shrinking in other Asian countries such as Indonesia and Japan shows the improvement is not yet widespread.

- Internal uptick is evident in China, South Korea, Vietnam

- Lack of international options could boost domestic leisure travel

COVID-19 has decimated airline capacity and demand throughout the region. Yet some of the countries that were initially worst-affected are now recovering most strongly, while other countries are still near the peak of the coronavirus outbreak.

Domestic air travel is generally expected to rebound sooner than international demand in most markets. Internal travel restrictions will be lifted before border closures, giving an initial advantage to airlines with extensive domestic networks.

China, where the COVID-19 virus originated, has already demonstrated this trend with an increase in domestic capacity over the past few months. Travel demand is likely to accelerate further, following the easing of domestic travel restrictions in Beijing on April 30. Another positive sign is the government’s decision to hold the annual meeting of the National People’s Congress in Beijing on May 22, after previous postponements.

South Korea was one of the hardest-hit countries in the early days of the pandemic but has since had great success in containing the virus and reversing its spread. Various global restrictions eliminated virtually all international service to and from South Korea, and while domestic flights continued, they were significantly reduced.

South Korean carriers are now beginning to reinstate services in the country’s small but busy domestic network. Korean Air’s domestic seat capacity was down 60% in April compared with a year earlier, but it expects to have a smaller decline of 52% in May.

Until April 28, Korean Air was operating just 36 daily domestic flights, with only six of its 17 routes open. However, by May 18 it plans to be flying 59 daily flights on 15 domestic routes. It also operated 15 routes during the April 29-May 5 holiday period.

Another South Korean airline, Jeju Air, cut its domestic flights by more than 50% due to COVID-19. But the low-cost carrier confirmed it is also starting to increase its schedule.

Vietnam is the latest Asian market to begin a domestic travel recovery. Government restrictions meant that at one point Vietnam Airlines was reduced to operating just a single daily flight on the Hanoi-Ho Chi Minh City route, previously one of the busiest in the region. It was operating only two other domestic routes, each with three flights a week.

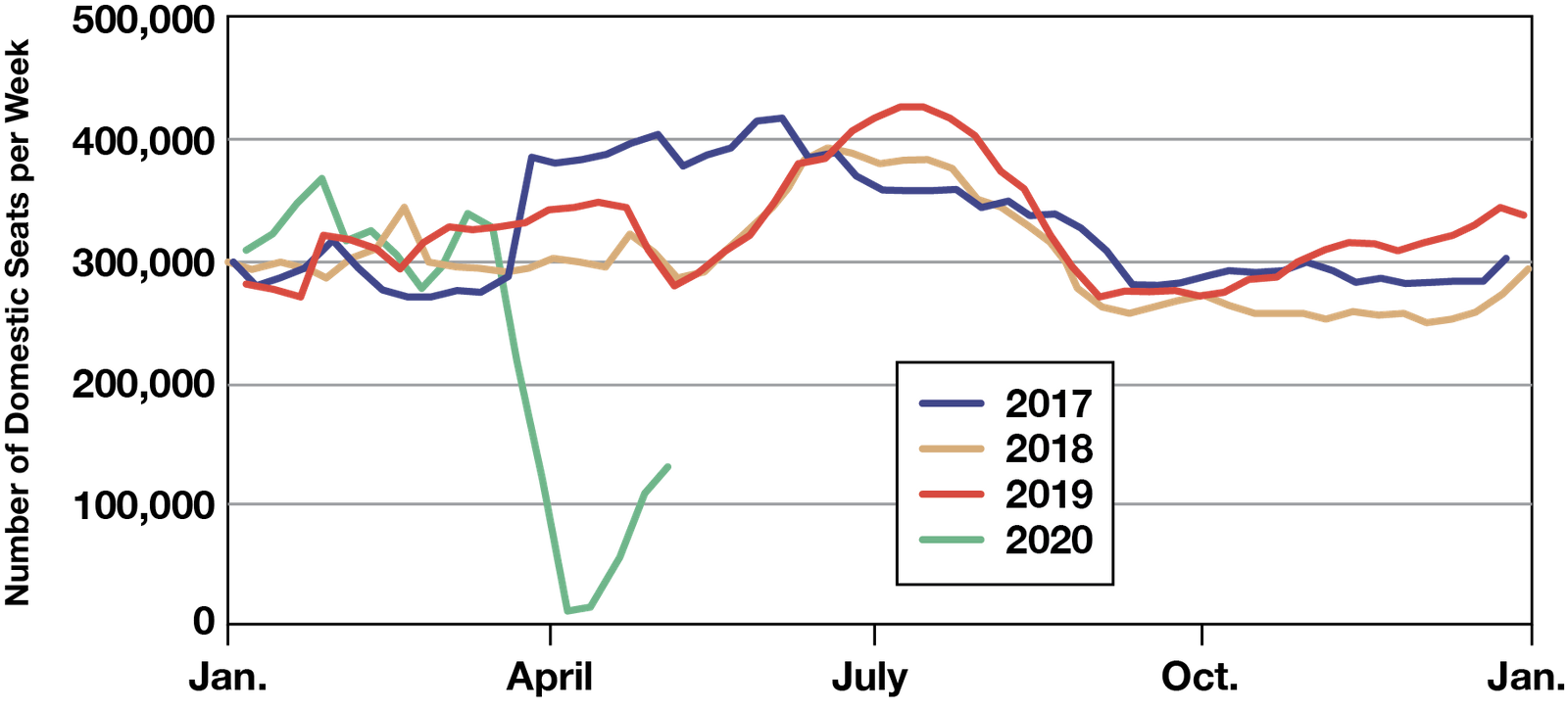

Vietnam has garnered praise from other countries for the effectiveness of its response to the coronavirus pandemic, and the government has progressively allowed domestic flights to increase. Data from CAPA – Centre for Aviation and OAG show that Vietnam Airlines’ domestic seat capacity bottomed out in early April, before starting to rebound. Rival VietJet Air shows a similar pattern.

The biggest change came on April 23. At that time, Vietnam Airlines increased frequency on the Hanoi-Ho Chi Minh City route to 4-6 flights a day, and then raised this to 11 times daily in May. Frequency also rose on the other trunk routes on April 23, and about 20 previously suspended routes to secondary destinations were restarted.

Vietnam Airlines Domestic Capacity, 2017-April 2020

Sources: CAPA - Centre for Aviation and OAG

Malaysia-based airlines AirAsia and Malindo Air had both shut down their domestic operations due to COVID-19, but the two airlines resumed a limited number of flights during the week of April 27. Initial demand will remain very low, however, as the country’s travel lockdown has been extended until May 12.

In Malaysia and elsewhere, the lack of international travel will reduce feed into the domestic network. But conversely, it should also provide a spur to domestic travel as international outbound options will remain limited for longer.

Domestic travel demand in Malaysia has the potential to rebound to 75-80% of 2019 levels by the end of this year, said PwC’s Edward Clayton during a webinar organized by the EU-Malaysia Chamber of Commerce and Industry (Eumcci). Demand for overseas holidays will be “refocused” on domestic destinations, he said.

This dynamic could even see Malaysia’s 2021 domestic air travel grow compared with 2019 levels, independent analyst Brendan Sobie said during the Eumcci event. Domestic tourism could “help fill the void” left by restricted international travel, he said. This would lead to opportunities for states such as Sabah and Sarawak in East Malaysia.

Despite encouraging signs in a handful of countries, the short-term picture remains bleak in many other markets. Japanese domestic capacity has not yet rebounded, and Japan Airlines has seen its flight cuts climb from 37% in early April to an estimated 68% by May 10. All Nippon Airways has also reduced its domestic flights by 70% as of April 28. Japan’s government this week extended a state of emergency and domestic movement restrictions through May 31.

Indonesia’s domestic market was less affected by COVID-19 than many other countries in the region. However, this situation changed dramatically on April 24, when the Indonesian government banned scheduled passenger services until June 1. This is part of an effort to restrict the traditional visits to hometowns during the Ramadan and Eid periods in response to fears that such mass movements could spread the coronavirus. The government has said the end date will be extended if necessary.

Overall, the Asian airline industry is still in an anemic condition compared with just four months ago and will remain so for some time. But with good news in short supply, the examples of emerging growth at least show there is light at the end of the tunnel.

Source by Aviation Week